The battle between consumer demand and COVID anxiety

October 7, 2021

There’s a tug o’ war happening right now in the heads of American consumers, and indeed, consumers all over the world. It’s a battle between their desire for normalcy and the never-ending saga that is COVID-19.

Just as the summer months ushered in the promise of a relative return to normal behavior, Fall 2021 is being marked by a surge in new COVID cases, along with a surge in COVID-related anxiety. Hospitals are filling up as cases rise, reminding everyone of life a year ago in the midst of the COVID lockdown. And yet, in many ways, consumers are behaving more like it’s 2019 than 2020.

To the delight of brands across the board, consumer spending was up substantially in Q2 of 2021, driven by pent-up demand, a strong economic outlook, government assistance, and a general belief that COVID was on the wane. Three months later, COVID has come roaring back, yet many consumers are unwilling to lock themselves down once more. And there appears to be little government interest in many parts of the country to force the issue.

The result? A marketplace in which consumers continue to spend at high levels, even as COVID anxiety refuses to go away. For Slingshot’s latest consumer forecast, we surveyed 300 American shoppers, and their responses echoed this newfound tension.

Here are five key takeaways from our research.

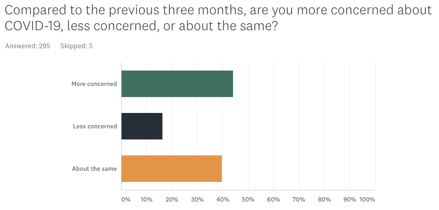

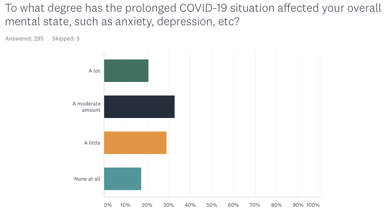

1. COVID anxiety is back, big time.

Going into the fall, 44% of respondents claim that they are more worried about COVID than they were three months ago. That’s a massive 33% uptick. What’s more, over half acknowledge that the ongoing COVID situation is taking a toll on their mental and emotional well-being. Only 17% of those surveyed claim that COVID has had no effect on them at all.

This figure includes the 62% of likely leisure travelers who say that COVID is having a moderate or significant impact on the plans they make. And nearly the same number also claim that COVID has already influenced how they plan to travel in the coming year.

It’s a similar story with dining out. Approximately 54% of consumers expect to eat out one or more times a week this fall, yet only about a third of them claim that COVID is having no impact on the dining choices they make. For most restaurant-goers, COVID is still weighing heavily on their decisions.

2. Consumer activity is being driven by seasonal forces.

Traditionally, many consumers see fall as a time to travel for family visits, start cooking and eating cooler weather foods, and buck up on healthy activities after any summertime lapses. The good news for brands that count on this seasonal shift in behavior is that’s precisely what seems to be happening this year.

Here are a few seasonal behaviors we can expect this fall, even as COVID anxiety continues to mount:

- Fall family travel is likely to be busy, especially around the Thanksgiving break.

- Restaurant-going will likely decline in favor of cooking at home.

- Seasonal comfort foods like oven-roasted items, soups, stews, and chili will be back in demand.

How else will diners behave this fall? Get your copy of our Fall Everyday Dining Forecast here.

3. Home-based activities will likely increase this fall.

While autumn is typically a time when people start to nest more, this seasonal shift will likely be compounded by the high number of people who continue to work from home. In one study cited by Food Business News, employees are still working from home an average of one day more per week than they did pre-pandemic. That adds up to a 20% shift in work-from-home behavior versus two years ago. That’s a lot of people spending time at home — not just working, but eating, shopping, and much more as well.

Some of this can be attributed to the pressure employers are under to keep employees happy in a market where qualified workers are in high demand. In an especially telling move, accounting services firm PwC recently announced plans to allow its entire North American workforce of 40,000 employees to work virtually from now on. And in another sign of a longer-term shift to more home-centric activity, 28% of consumers in a recent McKinsey report claimed to have made some form of renovation to better support working and exercising from home.

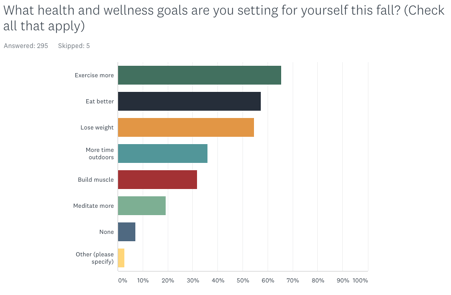

4. People are seeking a variety of wellness solutions.

Health and wellness brands should be heartened by the broad interest we’re seeing from consumers seeking ways to stay healthy, with diet and exercise leading the charge.

27% of respondents also intend to take vitamins more often than they did this summer, with immune support accounting for nearly one-third of that activity. Does this mean that consumers are looking for more ways to stay healthy as COVID refuses to go away? The numbers would certainly suggest it.

5. Changes in online shopping appear to be here to stay.

One of the most predictable shifts in consumer behavior during the COVID lockdown was toward more e-commerce. What was less understood was whether that behavior would revert to brick-and-mortar experiences once people felt comfortable leaving home again. Now the results are finally coming in. According to McKinsey, e-commerce has realized sustained growth of 35%, while brick-and-mortar has remained essentially flat. This indicates that, at least in some sectors, a full recovery is unlikely as consumers have moved permanently toward digital experiences.

The same study also indicates that a substantial amount of loyalty shake-up has occurred across consumer categories. Upwards of 40% of consumers have switched brands or retailers since March of 2020 — and much of that movement has been toward brands that offer preferred digital experiences.

While the push toward normalcy continues, it’s worth pointing out that it’s hardly universal. Although travel demand is up from a year ago, we’re still not back to pre-COVID levels, especially when you factor in the lagging business travel segment. Other categories, such as out-of-home entertainment, also have a long way to go.

With COVID not expected to go away anytime soon, the big question facing consumers and marketers as we head into 2022 won’t be how much behavior returns to normal, but rather how much COVID becomes a normal fact of everyday life.