Who's Buying in 2023 and What's Impacting Consumer Purchase Intent?

January 17, 2023

If there’s one thing we can count as 2023 starts to unfold, it’s that there’s little to count on. Depending on who you talk to, we’re either destined for a recession, or headed towards a nice soft landing. And as for consumers? They’ll either keep on buying like last year, or they’ll pull back on non-essential spending.

What we do know is that as inflation ballooned in 2022, consumers were able to offset rising prices by dipping into savings that had grown substantially over the past few years. Pandemic relief checks and near-zero borrowing rates made it easy for Americans to bolster personal savings accounts. For a large portion of the population, savings actually doubled in the years since 2020.

Those days appear to be over. Relief checks are gone and interest rates are on the rise. And those savings so many have counted on to maintain quality of life? They’re dwindling fast. Consider this: in April 2020 the personal savings rate was over 33%, according to Morgan Stanley. In October 2022? It was just 2.3%.

At the same time, revolving credit card debt has reached an historic high, climbing 19% year over year according to TransUnion. This increase was driven largely by younger consumers. Among Gen Zers alone, balances rose a staggering 72%.

But there’s more to the 2023 consumer landscape than meets the eye. Unemployment remains low, which adds to consumer confidence and a willingness to spend. And in a further encouraging sign, inflation does appear to be easing.

What does all this mean for marketers? While much uncertainty still exists, it’s clear that specific consumer groups are more likely than others to represent the best target audiences for many brands.

So who are they? To find out, we tapped into MRI-SIMMONS consumer data from both the Spring and Fall of 2022* to see how attitudes, sentiments, and intentions might be changing.

Here are five key takeaways from this study:

- The short-term news for brands and marketers is good, as most people appear happy to keep spending at about the same levels as they have been since last Spring.

- High earners between 25-44 who bring in at least $100k represent the most confident consumer groups out there, though that confidence has declined since the Spring of 2022. For many marketers, this will be a “bullseye” audience in 2023.

- Retirees on fixed incomes are the least confident consumers, and the only group for whom higher annual earnings don’t equate to higher confidence. Their spending intentions, however, remain largely unchanged. That’s good news for brands who target older audiences.

- While purchase intent ticked upwards slightly among higher earners across all age groups, it remained essentially unchanged for those earning under $100k.

- Across all groups, economic confidence does not appear to be directly connected to spending intent, at least for now.

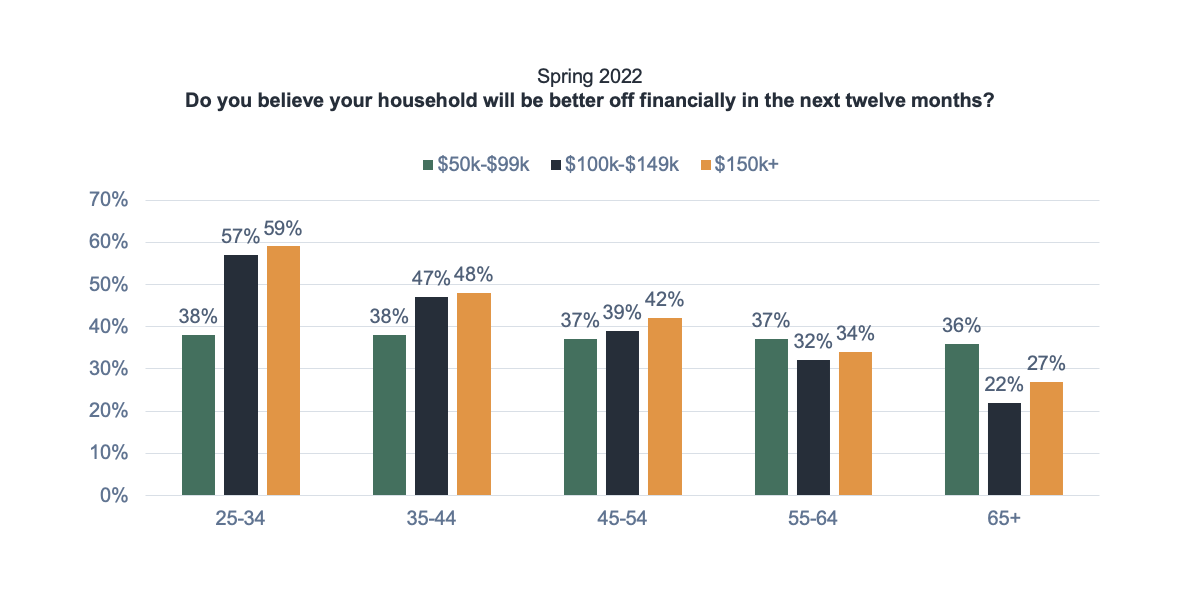

Let’s take a look at consumer sentiment in the Spring of 2022. At this point in time, inflation was on the rise, but interest rates were still at historic lows and the job market was strong.

It’s not even close here. By far the most confident consumers last Spring were Young High Earners (YHEs)– those 35 and under with household incomes of over $100k. What’s equally striking is that this level of confidence was about twenty percent or more higher than anyone earning under $100K regardless of age.

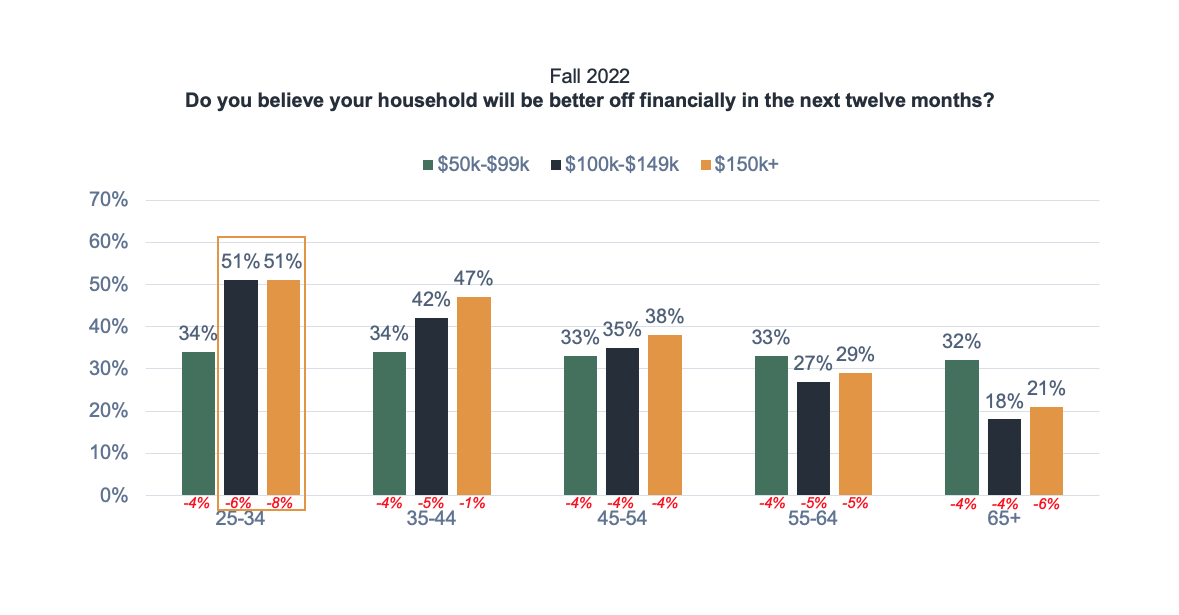

Fast forward to October of 2022, and what do we see?

Across the board, sentiment has trended downward, with the largest dips seen among those same Young High Earners. While they still represent the most confident consumer group, the gap has narrowed. Across the board, confidence has fallen by 4% or more, with one exception: among high earners in the 35-44 age range, sentiment has essentially stayed the same.

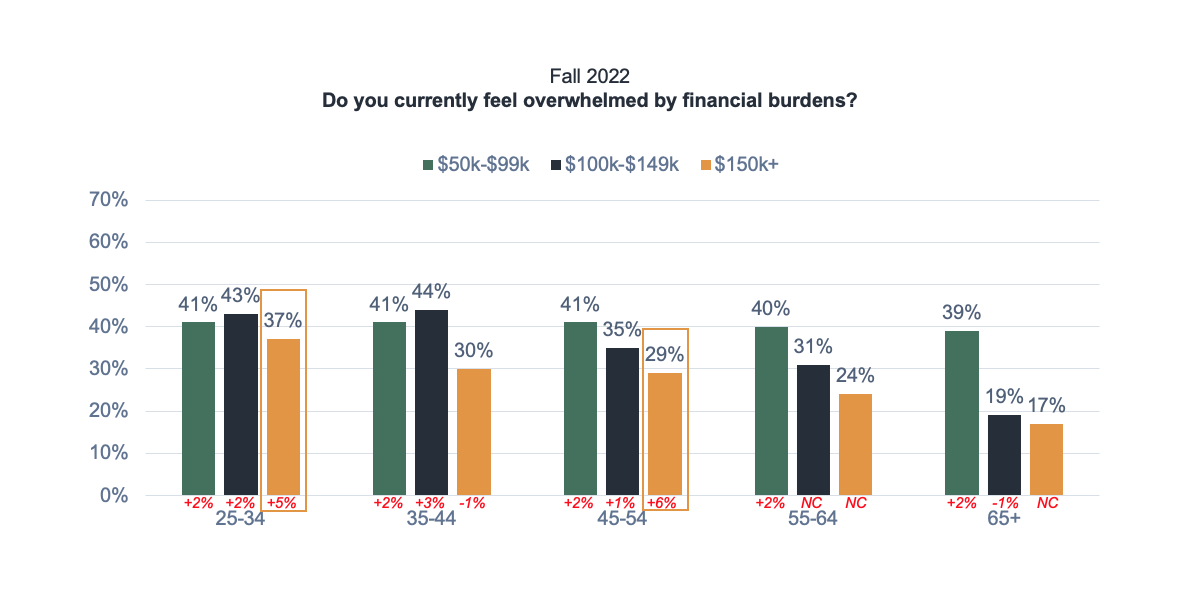

Given the above findings, it’s no surprise that we also see a slight uptick in people feeling financially overwhelmed as well.

Young High Earners are growing increasingly overwhelmed by finances, which only makes sense as their overall financial confidence is starting to fall. Economic uncertainty (coupled with lingering inflation and swelling credit card bills), is beginning to take root.

The big question is, how will this impact their consumer behavior next year? When we look at their purchase intentions across three non-essential spending categories, the answer appears to be not much at all.

We looked at how likely our target audiences are to spend on major appliances, home furnishings, and domestic travel in the next twelve months, and here’s a rundown of what we discovered:

- Consumers under 55 who earn at least $100K are as or slightly more likely to buy major appliances or large household furnishings.

- For those earning less than $100K at any age, purchase intent for major appliances and large furnishings remained unchanged, though still consistently lower than higher earners.

- Those most likely to buy major appliances or large furnishings are $100K+ earners in the 35-54 age groups.

- Travel intention remained strong and nearly unchanged from Spring to Fall, with $100K earners of all age groups between 7% and 10% more likely to travel domestically for leisure in 2023.

While this all bodes well when it comes to purchase intent, we would caution that intentions aren’t everything. Circumstances have a way changing when people are projecting months or a year in advance. Given the shaky ground that many people appear to be on financially, it’ll be critical for marketers to keep a sharp eye on how well their target audiences are weathering the current economic storms, and be ready to pivot as 2023 unfolds.

*Source: MRI-SIMMONS Spring and Fall 2022 consumer surveys