Slingshot Winter Consumer Forecast: New Year, Same COVID

December 10, 2020

Imagine being told this time last year that one of the most common themes for marketing in 2020 would be encouraging people to stay home? Or that a virus would play a bigger role in brand communications than BOGO offers or new product launches?

What a difference a year makes. And today, the biggest question on the minds of marketers and their customers alike is when is it all going to end? Not yet, unfortunately. But thankfully, many signs point to soon.

That’s a sentiment that’s reflected in our Winter 2020/2021 Consumer Forecast. We see a renewed urgency to stay vigilant against COVID-19, but also a strong desire to get back to normal.

For the forecast, we conducted a series of year-end consumer surveys designed to understand how shoppers will likely behave as we head into the New Year. We surveyed a combined 500 American consumers across multiple generations and income levels. The consumer categories we explored include travel, dining, packaged goods, nutrition, healthcare, and general health and wellness.

The bottom line? The end-of-year surge in COVID cases has created a corresponding rise in anxiety about many consumer activities. But there are a few silver linings, too. Here are the five big takeaways for brands as we head into 2021:

1. Consumers are pulling back across multiple categories.

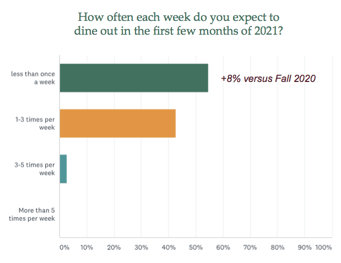

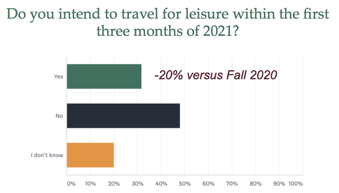

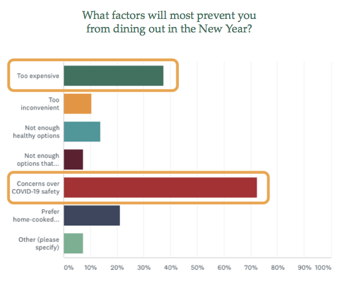

All indicators point to rising levels of anxiety around COVID-19 having a real impact on consumer behavior in the New Year. We can expect fewer people to travel, shop in-person at retail, or frequent restaurants (for both dine-in and to-go).

Given the endless stream of grim news regarding COVID-19 these days and all the restrictions being implemented as a result, it’s easy to see why people are resigned to another few months of staying put.

2. "Stay-at-home fatigue" is real.

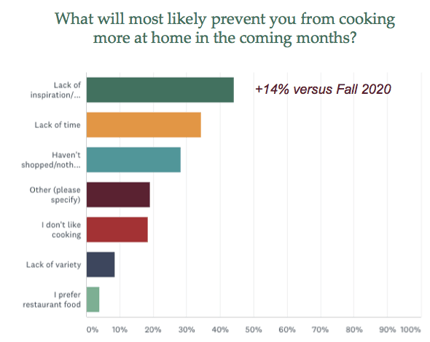

While people are more inclined to stay home, that doesn’t mean they’re happy about it. In fact, we see evidence that “stay-at-home fatigue” is building fast. Compared to the fall, consumers are less inspired to cook, to exercise at home, or to adopt a new diet.

For many brands, there’s actually good news in this. That same feeling of malaise should correspond with rising pent-up demand for more traditional consumer behavior once a COVID vaccine becomes widely available. For example, advance cruise bookings for late 2021 are already strong, with fully half of cruisers planning to hit the ocean again within the next year. And as more people begin commuting again, the energy sector also stands to benefit. The conditions for a surge in consumer activity are so strong, in fact, that CNBC’s Jim Kramer is forecasting a “Pent-Up Demand Bull Run” in 2021. On the flip side, some economists believe such a fast rise in consumer spending could drive up prices and lead to inflation.

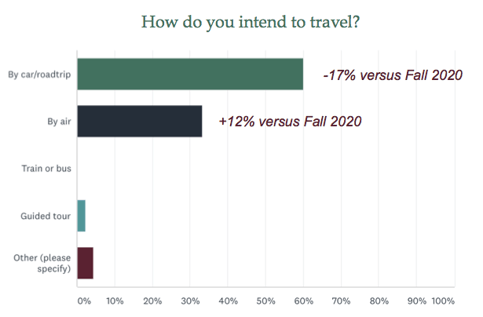

3. Confidence in air travel is trending skywards.

In an encouraging sign for air travel, Hawaiian Airlines is betting on renewed demand for leisure trips and has announced route expansion plans to several U.S. cities for the spring.

Hawaiian may be seeing what we’re seeing as well: a growing sense of confidence in air travel again. In fact, according to our survey, more affluent travelers plan to fly in the New Year than drive for leisure travel– another positive sign for the airlines.

The industry as a whole has done a pretty good job of keeping the public abreast of their safety protocols. That, coupled with pent-up demand for travel, could lead to better skies ahead.

4. For some consumers, it’s about more than COVID.

Often lost in all the news about COVID-19 is the reality that for millions of Americans, the biggest barrier standing between them and more spending is money. Some 12 million laid-off Americans, already strapped for cash, stand to lose government benefits by year end. Millions more have dealt with payroll reductions or are supporting adult family members. In one telling statistic, nearly 40% of younger Millennials have been forced to move back in with their parents—the highest rate ever recorded.

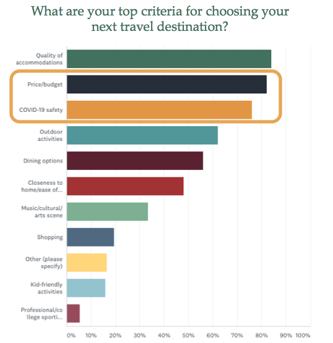

We see this reflected in our research as well, with “cost” coming up as a major hurdle for many potential shoppers. And among likely travelers in the New Year, price actually outranks COVID-19 among their top concerns when choosing a destination.

Brands should continue to take a proactive approach to this price sensitivity by offering deals and promotions that keep potential customers interested. As we’ve seen in previous studies, even the most well-heeled consumers are prone to seek out value in times of disruption.

5. Some consumer groups are more likely to spend than others.

In general, young consumers appear to be more price sensitive versus older ones—no surprise given how hard the recession has hit young Millennials and Gen Zers. Yet they are also the consumers most likely to engage in online shopping activities.

In the travel sector, overall travel intention is still way down. However, among those who do plan to travel early in the New Year, potential travelers in higher income segments ($150K+) are nearly twice as likely to take a vacation of five or more days versus their lower income counterparts.

According to our findings, the difference is also striking in the health and wellness sector. Compared to general audiences, higher income groups are:

- 24% more likely to use a smart device to monitor health

- 10% more likely to purchase exercise equipment

- 11% more likely to download or subscribe to health/wellness apps, and

- 23% more likely to use telehealth services

There’s no doubt that the first quarter of 2021 will be a tricky one for brands, but there does appear to be some light in the tunnel ahead. In the meantime, brands will be smart to enter into the New Year continuing to proactively address concerns over COVID safety while also providing the deals and promotions in order to ease some of the financial anxiety shoppers continue to feel.